18 Top Passive Income Apps (Your Guide to Earning While You Sleep) [2025]

Disclosure: This post contains affiliate links, meaning that if you purchase something through the links below, I will receive a commission at no cost to you. Learn more.

Last month, I was scrolling through my bank statement when something caught my eye – I had earned $237 without lifting a finger. The source? A handful of passive income apps running quietly on my phone.

After sharing this discovery with friends over dinner, I realized how many people were curious about these digital money-makers but didn’t know where to start.

Six months ago, I decided to experiment with every legitimate passive income app I could find. My phone became a laboratory of sorts, testing everything from bandwidth sharing to micro-investing.

Some apps were duds, others surprised me, and a select few became permanent fixtures in my income strategy.

🏆 FREE AI Side Hustle Training

🤖 Start Getting Paid from AI

Forget complicated prompts and coding. These 5 ‘lazy’ AI methods are generating $1K+ monthly for everyday people with zero tech skills.

The Real Story Behind Passive Income Apps

Searches for “passive income” have surged by over 200% in the past five years, reflecting a significant increase in interest as people seek financial independence and alternative income streams

Here’s the truth about passive income apps that most articles won’t tell you: they’re not truly “passive” in the traditional sense.

You won’t wake up to millions, and some require initial setup time. But once you’ve done the groundwork, these digital tools can generate steady extra income while you focus on other things.

I remember feeling skeptical when my friend Sarah first showed me her earnings from these apps. “$50 a month for doing nothing? There had to be a catch,” I thought.

But after diving deep into this world, I’ve discovered that while individual app earnings might seem modest, the right combination can create a meaningful income stream.

Some days I forget these apps are even running until I get a payment notification.

Visit Paid surveys - Earn up to $100/taskData Sharing and Internet Bandwidth Apps

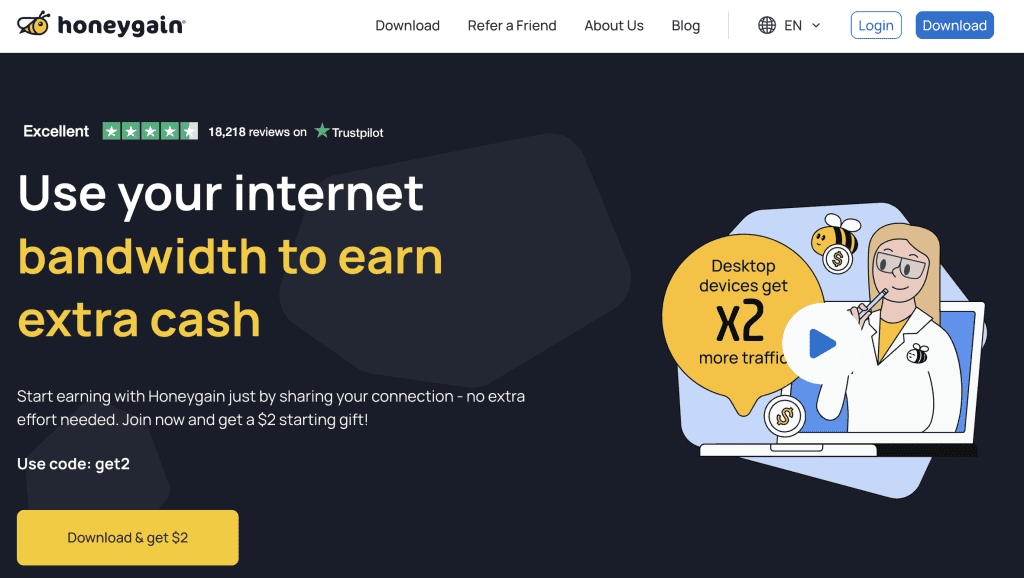

⚡️NEWSFLASH: Your unused internet bandwidth could be making you money right now.

Data sharing apps have emerged as one of the most hands-off ways to generate passive income. These apps securely share your excess internet bandwidth with businesses for market research, content delivery, and web services.

While individual earnings might seem small, running multiple bandwidth-sharing apps simultaneously can create a steady stream of truly passive income.

1. Honeygain

After running Honeygain for several months, I can confirm it’s one of the most hands-off ways to earn passive income.

The app pays you for sharing your unused internet bandwidth, offering about $1 for every 10GB shared. I’ve consistently earned between $40-50 monthly, which easily covers my streaming subscriptions.

The setup is straightforward: install, create an account, and let it run in the background.

2. Pawns.app

This newcomer to the bandwidth-sharing scene offers a competitive rate of $0.20 per GB shared. What sets Pawns apart is its lower minimum payout threshold of just $5, making it easier to access your earnings.

I’ve found it works particularly well when paired with Honeygain for maximizing bandwidth monetization.

3. MobileXpression

Here’s a simple one: install the MobileXpression app on your phone, share your mobile data usage patterns, and earn a steady $5 monthly.

While the earnings are modest, it’s genuinely passive – I haven’t opened the app in months, yet the rewards keep coming.

Just remember, it does use some battery life.

Cashback and Shopping Rewards Apps

Why not earn money from purchases you’re already making?

Cashback apps have revolutionized how we shop, offering returns of up to 40% at thousands of retailers. The key is to stack multiple apps and always check for available rewards before making a purchase.

With strategic use, these apps can put hundreds of dollars back in your pocket annually.

4. Rakuten

Rakuten has become my secret weapon for online shopping, offering up to 40% cashback at over 2,500 stores.

The browser extension automatically alerts you to available cashback, so you never miss an opportunity.

Last quarter, I earned $87 just by doing my regular online shopping.

Pro tip: their quarterly Big Fat Check payments via PayPal or check make for a nice bonus.

5. Ibotta

Gone are the days of clipping coupons. Ibotta has streamlined saving money on groceries and everyday purchases.

The app offers a generous $20 sign-up bonus, and I’ve found their receipt scanning process much improved in 2025.

My favorite feature is the ability to link loyalty cards for automatic savings – I averaged $150 in cashback last year without changing my shopping habits.

6. Capital One Shopping

Don’t let the name fool you – you don’t need a Capital One card to use the Capital One Shopping app. It automatically applies the best available coupons and earns you rewards points for shopping.

The price drop alerts have saved me hundreds on big purchases, and the rewards points add up surprisingly quickly.

Investment and Savings Apps

The investment app landscape has transformed how we grow wealth.

These platforms have demolished traditional barriers to entry, making sophisticated investment strategies accessible to everyone.

From spare change investing to real estate portfolios, these apps offer the potential for both short-term returns and long-term wealth building.

7. Acorns

Acorns takes the micro-investing concept to the next level. By rounding up your purchases and investing the spare change, it makes building a portfolio painless.

I started with just the round-ups feature and now have a growing investment account worth over $1,200.

Their new sustainability portfolios really appeal to environmentally conscious investors.

8. Fundrise

Real estate investing used to require huge capital, but Fundrise has changed that completely.

With just $10 to start, you can invest in a diversified portfolio of real estate properties.

I’ve seen consistent returns around 8% annually, and the quarterly dividend payments make it feel like being a landlord without the headaches.

9. M1 Finance

In the current high-interest environment, M1 Finance stands out with their 5% APY high-yield savings account.

The automated investing features let you create custom portfolios or choose from expert-curated ones.

Their pie-based investing approach makes portfolio management surprisingly intuitive.

Survey and Task-Based Apps

While not entirely passive, these apps offer flexible earning opportunities that can fit into your daily routine.

The key is to focus on high-value activities and avoid spending time on low-paying tasks.

By being selective and strategic, you can generate decent supplemental income during your downtime.

10. Survey Junkie

What sets Survey Junkie apart is their passive earning feature that rewards you for sharing browsing behavior.

While the surveys provide extra income, the passive element runs quietly in the background, making it a hybrid between active and passive earning.

11. Swagbucks

Swagbucks rewards you for activities you might already be doing online. From shopping to watching videos, the points add up quickly.

I focus on their high-paying surveys and shopping rewards, earning about $50-100 monthly without much effort.

12. InboxDollars

InboxDollars offers a straightforward approach: complete tasks, get paid. Their email reading feature is particularly passive – just open sponsored emails for quick earnings.

Combined with their shopping rewards and survey opportunities, it’s a reliable source of extra income.

Real Estate and Rental Apps

The sharing economy has opened up new ways to monetize your existing assets.

Whether it’s a spare room, parking space, or vehicle, these apps help you generate income from resources you already own.

The key is to start with what you have and expand as you become comfortable with the process.

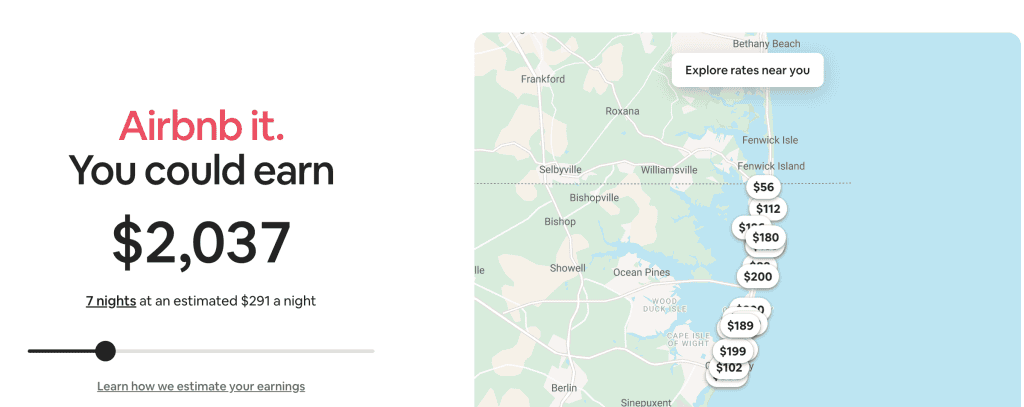

13. Airbnb

The short-term rental market is still going strong in 2025. Airbnb hosts in my area average $924 monthly from renting out spare rooms or entire properties.

I started by renting my guest room on weekends and now make enough to cover half my mortgage.

The platform’s updated host tools make managing bookings much easier than in previous years.

14. Turo

Think of Turo as Airbnb for your car. Users are reporting earnings up to $1,000 monthly by renting out their vehicles when they’re not using them.

The app handles insurance and screening, making the process relatively worry-free.

Electric vehicle owners are seeing especially high demand.

15. Neighbor

Got extra space in your garage, basement, or driveway? Neighbor lets you rent it out for storage. It’s like running a mini storage facility from your home.

The earnings vary by location, but urban areas can command premium rates for secure parking spots.

Crypto and Alternative Investment Apps

The world of alternative investments has become increasingly accessible through mobile apps.

While these options often carry higher risk, they also offer unique opportunities for portfolio diversification and potentially higher returns.

The key is to approach these investments with caution and never invest more than you can afford to lose.

16. Crypto.com

For those interested in cryptocurrency, Crypto.com offers various ways to earn passive income through their platform.

Their staking rewards and interest-earning programs can be quite lucrative, though remember that crypto investments come with higher risk.

17. Ember Fund

This app simplifies crypto investing with a unique daily rewards system. By simply opening Ember Fund and clicking a button daily, you can earn Bitcoin rewards.

It’s not huge money, but it’s probably the easiest way to start accumulating cryptocurrency.

18. Masterworks

Art investing goes digital with Masterworks. The platform lets you buy shares in blue-chip artwork, potentially profiting when pieces are sold.

While it’s a longer-term investment, it’s fascinating to own pieces of million-dollar artworks and diversify beyond traditional assets.

How to Choose the Right Passive Income Apps

Selecting the right passive income apps requires careful consideration of several factors. Based on my experience testing dozens of apps, here’s what you should evaluate before committing your time and resources:

Key Selection Factors

- Geographic Availability: Not all apps work in every country. Check if the app operates in your region and what limitations might exist for international users.

- Device Compatibility: Some apps only work on specific devices or operating systems. For example, certain bandwidth-sharing apps perform better on desktop than mobile.

- Payout Methods: Consider how you’ll get paid. While PayPal is common, some apps offer crypto payments, gift cards, or bank transfers. Look for apps that offer payment methods you can easily access.

- Minimum Payout Thresholds: Apps like Pawns.app let you cash out at just $5, while others might require you to accumulate $25 or more. Lower thresholds mean faster access to your earnings.

- Privacy and Data Security: Particularly for data-sharing apps, understand what information you’re sharing and how it’s protected.

Tips for Success

After six months of trial and error with these apps, I’ve learned that success isn’t about downloading every app you can find. Instead, it’s about being strategic and building a sustainable system.

My first month, I overwhelmed myself by trying to manage ten apps at once. Now, I follow these guidelines that have helped me maintain a steady passive income stream without the stress:

- Start with 2-3 apps that match your lifestyle

- Focus on apps that complement your existing habits

- Check minimum payout thresholds before investing time

- Track your earnings across apps to optimize your strategy

- Join app-specific communities to learn optimization tips

Advantages and Disadvantages of Passive Income Apps

Before diving into the world of passive income apps, it’s important to understand both their benefits and limitations. Here’s what I’ve discovered after months of testing:

Advantages

- Low Barrier to Entry: Most apps are free to start and require minimal technical knowledge.

- Flexible Time Commitment: You can manage most apps around your schedule and lifestyle.

- Multiple Income Streams: Running several apps simultaneously can create meaningful combined earnings.

- Educational Value: Investment apps particularly help build financial literacy and investing habits.

- Automation Potential: Once set up, many apps require minimal ongoing maintenance.

Disadvantages

- Modest Initial Returns: Individual app earnings often start small, taking time to become significant.

- Privacy Considerations: Data-sharing apps require careful attention to privacy settings and data usage.

- Device Impact: Some apps can affect device performance or battery life.

- Geographic Limitations: Not all apps are available worldwide, and earnings can vary by location.

- Initial Setup Time: While “passive” long-term, most apps need upfront time investment for optimal setup.

The Reality Check

Let’s be honest – none of these apps will replace your day job. The term “passive” can be a bit misleading too.

Most require some initial setup, and some need occasional maintenance. But if you’re looking to earn extra money without significant time investment, these apps can be valuable tools in your financial toolkit.

Looking Ahead

As we move through 2025, the passive income app landscape continues to evolve. New players enter the market regularly, and existing apps keep improving their offerings.

The key is to stay informed but not chase every new opportunity – focus on what works for you and your lifestyle.

Remember, the best time to start building passive income streams was yesterday. The second best time? Right now.

Have you tried any of these passive income apps? What has your experience been like? Share your thoughts in the comments below!